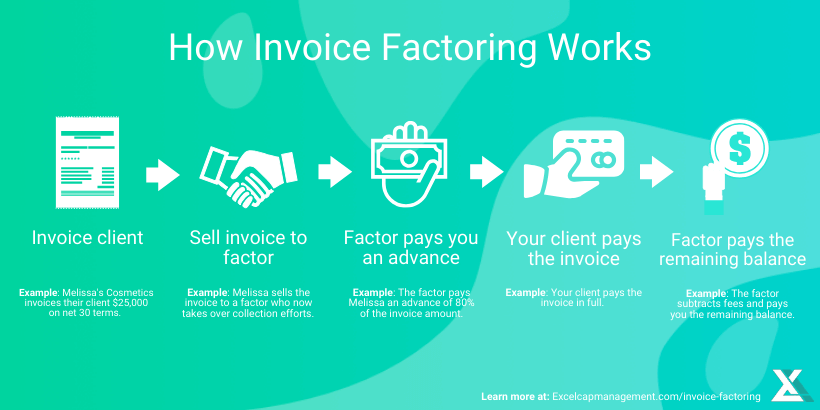

With invoice discounting and factoring, the credit terms often mean that they will take care and provide money across all unpaid invoices on the sales ledger. Invoice financing is sometimes known as ‘accounts receivable funding’. Businesses will have to sell the entire amount of unpaid invoices from the sales ledger to the invoice discounting company. Invoice discounting is a form of short term business finance, which is used by businesses that use customer invoicing as their primary source of revenue. Once the total invoice is paid by the customer, the lender will take a fee from the remaining invoice amount. An invoice discounting facility provides the business with a percentage of the unpaid invoice upfront. Invoice discounting is where a business receives a percentage of an unpaid invoice in advance, rather than waiting for 30+ days for the customer to pay the invoice. The main types of invoice finance are:īesides invoice discounting, there are several invoice financing options available which are provided by invoice finance companies. Unpaid invoices signify money that is owed to your business, invoice finance helps to cover this intermediate period which means your business won’t be out of pocket whilst waiting for payment terms to elapse. This funding solution, offered by invoice factoring companies such as Penny, aids businesses in maintaining cash flow, enabling suppliers and employees to be paid on time and daily business operations to continue running smoothly. Invoice factoring comes under the umbrella term invoice finance, which is the process of borrowing money to cover the number of unpaid invoices that clients owe your business.

0 kommentar(er)

0 kommentar(er)